At a Glance:

Given the limited time to implement zero-emission technologies for hard-to-abate sectors, carbon markets offer a crucial, near-term solution by facilitating the exchange of credits for emissions reduction.

This article provides a comprehensive understanding of carbon markets, their structure, and their immediate strategic implications for business leaders.

The global imperative to address climate change has reached a critical juncture, demanding urgent, coordinated action to limit warming to 1.5°C. Central to this effort, the carbon market has cemented its position as an indispensable tool in global climate action.

Far from being a niche environmental mechanism, carbon markets enable a market-based approach to reduce greenhouse gas (GHG) emissions while promoting economic efficiency and enhancing business competitiveness. They are necessary because implementing the technology required to reach zero emissions will take time, making carbon markets a practical bridge to manage today’s hardest-to-abate emissions.

But what exactly are carbon markets, how do they function, and why should businesses pay attention?

What is a Carbon Market?

The carbon market is a fundamental, market-based mechanism designed to accelerate global climate action by creating a financial incentive to reduce greenhouse gas (GHG) emissions.

At its core, carbon market provides a structured platform for the exchange of credits and allowances related to greenhouse gas (GHG) emissions. The entire system is built upon the trade of the carbon credit or offset, which is an instrument representing the reduction or removal of one metric tonne of carbon dioxide (CO2) or GHG emissions from the atmosphere.

The market’s foundational purpose is economic: to create a financial incentive to curb emissions. This mechanism is necessary because while businesses must commit to deep internal decarbonisation, implementing the required zero-emissions technology often takes time, the world does not have. Carbon credits allow companies to compensate for emissions they cannot eliminate immediately by investing in verified environmental projects, such as regenerative farming or forest conservation.

The Two Main Types of Carbon Markets: Compliance vs. Voluntary

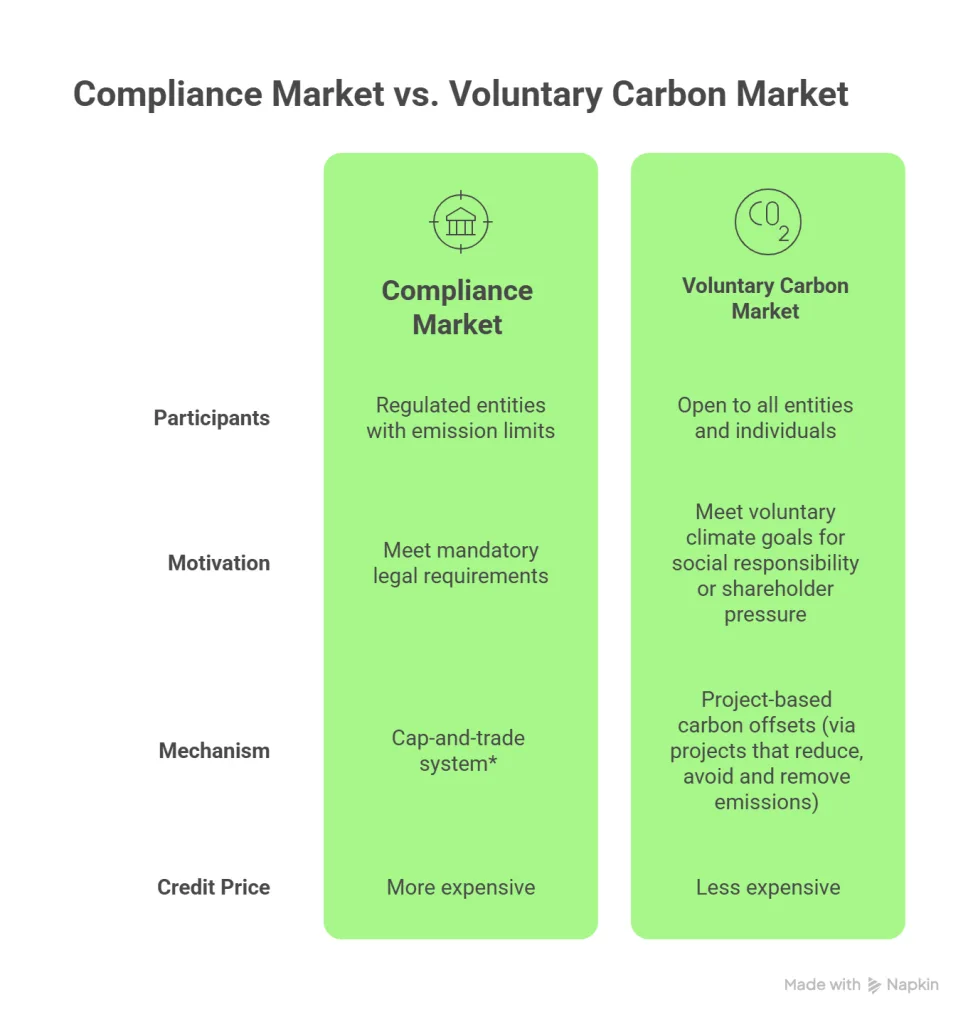

Carbon markets fall into two main categories: the mandatory Compliance Market and the Voluntary Carbon Market (VCM). While both aim to reduce emissions, they operate differently and involve different participants.

Table below depicts the difference between Compliance Market and Voluntary Carbon Market:

Cap-and-Trade: A government sets a “cap” (a limit) on total emissions and issues a finite number of allowances. Companies can trade these allowances.

How Carbon Markets Work

The carbon market facilitates the trade of two primary instruments, distinguished by the regulatory structure they operate within: carbon credits and allowances.

A. Carbon Credits (Voluntary Market)

Definition: A carbon credit or offset is an instrument that represents the reduction or removal of one metric tonne of carbon dioxide (CO2) or GHG emissions from the atmosphere.

Purpose: Credits enable difficult-to-decarbonise industries to reduce emissions immediately while continuing work towards deep emissions cuts. They enable companies to take responsibility for emissions they cannot yet reduce by providing finance for critical climate mitigation activities outside their value chain.

Source: Credits are generated through a project-based system. Examples of projects include regenerative agriculture, forestry initiatives (like avoiding deforestation), renewable energy, and industrial gas capture.

B. Allowances (Compliance Market)

Definition: An allowance is essentially a permit that allows an entity to emit GHGs.

Mechanism: A cap (limit) is set on the total amount of GHG emissions permitted, and tradable allowances are issued equal to this cap. This cap represents a finite supply.

Source: Allowances are created and governed by a cap-and-trade system regulated by national, regional, or international carbon reduction regimes.

Examples: Examples of compliance markets include the European Union Emissions Trading System (EU ETS), the UK ETS, and China’s national ETS

How Voluntary Carbon Credits Are Created and Verified

Voluntary credits are generated through environmental projects that deliver measurable and independently verified reductions or removals of greenhouse gases. Unlike compliance markets, the voluntary market is project-driven, with developers responsible for designing and providing activities that meet recognised standards of quality and integrity.

- Project Design and Development

Developers initiate projects that avoid, reduce, or remove emissions, such as renewable energy, afforestation, mangrove restoration, or regenerative agriculture. To qualify, the project must demonstrate additionality, proving that the emissions impact would not occur without the intervention. Each project follows an approved methodology that sets out how reductions are measured, calculated, and monitored. - Measurement, Reporting and Verification (MRV)

A credible MRV framework underpins the creation of high-quality credits. Developers collect and report data according to the chosen methodology, while the verification step is undertaken by an independent, accredited auditor. Technologies such as satellite monitoring, blockchain, and AI-enabled sensing increasingly support transparency and data accuracy. Verification bodies apply established standards, for example Verified Carbon Standard (Verra) or Gold Standard, to confirm that the claimed impact is real and consistent with the rules. - Certification and Issuance

Once verification is complete, the project is certified, and credits are issued through recognised registries. Integrity initiatives such as the Integrity Council for the Voluntary Carbon Market provide additional benchmarks, including the Core Carbon Principles, to define what constitutes a high-quality credit. Registries maintain full traceability, ensuring that each issued credit is uniquely identified and tracked through its lifecycle.

Following issuance, credits are made available for organisations and individuals seeking to offset residual emissions. A well-functioning voluntary market enables finance to flow into activities that deliver genuine and additional climate mitigation outcomes.

Why It Matters for Businesses

Carbon markets are transitioning into a major financial sector, projected to grow from USD 132.9 billion in 2025 to USD 576.4 billion by 2035. This growth, representing a CAGR of 15.8%, underscores their crucial role as a strategic imperative for all corporations.

1. Mandatory Compliance Costs: Demand for carbon credits is fuelled by increasing regulatory frameworks and the expansion of global carbon pricing systems. In compliance markets, carbon pricing will increasingly affect operational and product costs.

2. Cascading Supply Chain Costs: Compliance carbon costs imposed on hard-to-abate sectors (e.g., steel, chemicals) cascade through the supply chain to downstream products. This forces enterprises to transition to a low-carbon supply chain to maintain competitiveness.

3. Trade Policies: Export market pressures, such as the EU’s Carbon Border Adjustment Mechanism (CBAM), compel exporting enterprises to align with importers’ carbon footprint requirements to avoid carbon tariffs or market access restrictions.

4. Investor and Stakeholder Commitments: Investor pressure on net zero alignment and rising voluntary corporate pledges drive demand for high-quality credits. Companies pursuing voluntary targets, utilise carbon credits to support their decarbonisation efforts.

5. Digital Tools: Advanced technologies (AIoT, blockchain, privacy computing) are needed to enhance the authenticity and security of carbon data, creating value by reducing costs and enhancing efficiency.

Companies that integrate carbon markets into their ESG strategies thoughtfully—balancing compliance with innovation and transparency—will be better positioned to create long-term value.

At RenoirESG, we support and advise companies on how to integrate carbon offsetting as part of their broader decarbonisation and net zero strategies, in line with evolving best practices.

Our work focuses on helping clients determine when and how to use high-quality offsets alongside real emissions reductions, ensuring that carbon credits are credible and complementary rather than a substitute for abatement. We also advise organisations on aligning with – and preparing for compliance-related regulation such as the EU CBAM and other carbon pricing or allowance mechanisms.

Discover how your organisation can navigate carbon markets with confidence and clarity.